ALTO CryptoIRA®

Invest in Crypto Tax-Free1

*Traditional IRAs and SEP IRAs generally are tax-deferred; Roth IRAs generally can be tax-free.

Roth IRAs are generally tax-free subject to IRS rules regarding qualified distributions.

Why Invest in Crypto with an Alto CryptoIRA?

Avoid the hassle when you invest with an IRA.

200+ Cryptocurrencies

Choose from one of the largest selections of any crypto IRA via Coinbase integration.

Tax Advantaged

Avoid capital gains, plus get other tax benefits offered by traditional, Roth, and SEP IRAs.

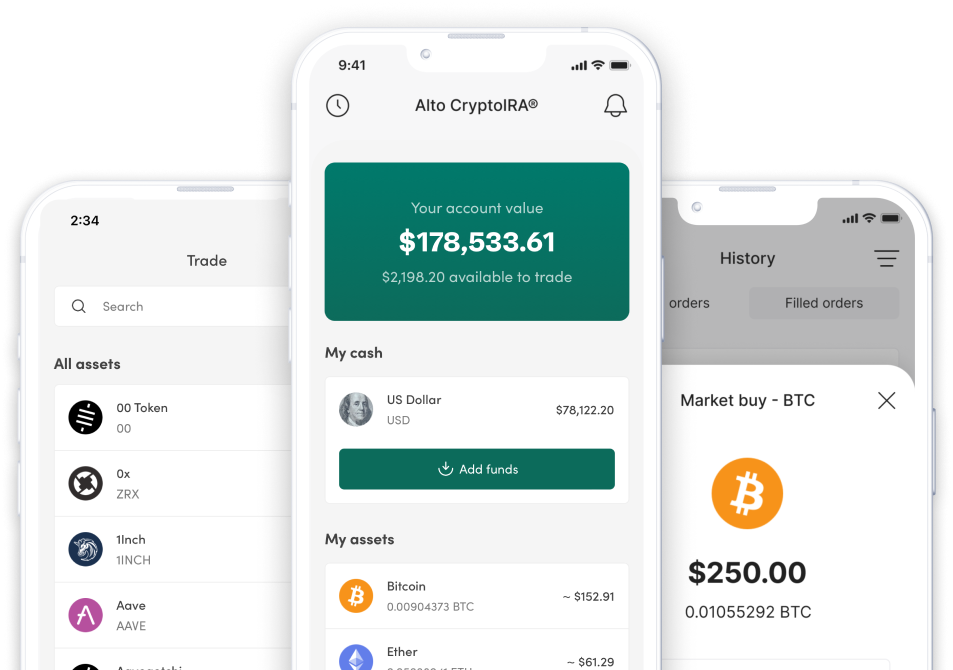

On-the-Go Trading

Buy and sell crypto whenever, wherever, with 24/7, real-time trading and our new mobile app.

Low Transparent Fees

Invest in cryptocurrency without the hidden fees and high minimums.

Market and Limit Orders

Place market orders at current prices or set a future price to buy or sell using limit orders.

Secure Storage

Your assets are held in FDIC-insured accounts (cash) or hot and cold storage (crypto) at Coinbase.

Never pay taxes with a Roth CryptoIRA2

Adding cryptocurrency to your IRA portfolio can diversify your investments and help you potentially achieve greater long-term growth potential.

- Roll over funds from an IRA, 401(k), 403(b), or other qualified account at no charge.

- 24/7, On-the-Go Trading

- Market and Limit Orders

Invest in Up to 200+ Cryptocurrencies3

Alto CryptoIRA® gives you access to one of the largest selections of any crypto IRA through our integration with Coinbase, the United States’ largest publicly traded crypto exchange.

BTC

Bitcoin

ETH

Ethereum

ADA

Cardano

MATIC

Polygon

faq

Got questions?

Well, we've got

answers.

Currently, any United States resident (with the exception of Hawaii residents) who is 18 years or older can open an Alto CryptoIRA.

No matter how much your investment grows, you’ll never pay taxes on gains in a crypto IRA. You may even be able to avoid taxes altogether. Upon eligibility to take distributions:

- Traditional and SEP IRA distributions are subject to income taxes only.

- Roth crypto IRA qualified distributions are completely tax-free.

Additionally, unlike when you trade crypto outside a tax-advantaged account, doing so within an IRA allows you to avoid the often-tedious process of reporting trades on your taxes each year.

With Alto CryptoIRA, you can invest with as little as $10.

We don’t believe in hidden charges, exorbitant fees, or steep investment minimums. What you see is what you get. The table below describes our fee structure. See legal terms and pricing. Pricing and terms subject to change.

The Alto CryptoIRA can only hold cash and investments in cryptocurrencies bought and sold through the Coinbase exchange. Out of an abundance of tax caution, we do not allow you to invest in non-crypto related assets from your Alto CryptoIRA. You may, however, open additional Alto accounts to make non-crypto related investments.

2) Tax-free treatment subject to Roth IRA holding period and other restrictions. Tax treatment of contributions and distributions subject to applicable regulations. Consult your tax advisor before investing.

3) Quantity and selection of tokens/coins available from CryptoIRA exchange partners may vary from state to state.