Raising capital has

never been easier

Create your offering and invite investors in less than 10 minutes with Alto’s capital raising platform.

Unlock $10T+ in retirement capital in minutes

With investors looking to alternative assets for outsized returns and portfolio diversification—and more than $10 trillion locked in IRAs in the US—there’s never been a better time to raise capital with retirement funds.

Access

Tap into a larger pool of investable assets by accepting IRA capital.

Efficiency

Create your offering and kick off your capital raise in just 10 minutes with our platform.

Trust

Count on a single, reliable provider with industry-leading service.

Raise capital with Alto

We built our platform to make the historically cumbersome process of raising IRA capital easy. There’s no need to book a call, and no waiting for your offering to go live. Plus, if you ever need help, our world-class customer service has you covered.

Assets Under Administration

Average Investment Size

Issuers and Counting

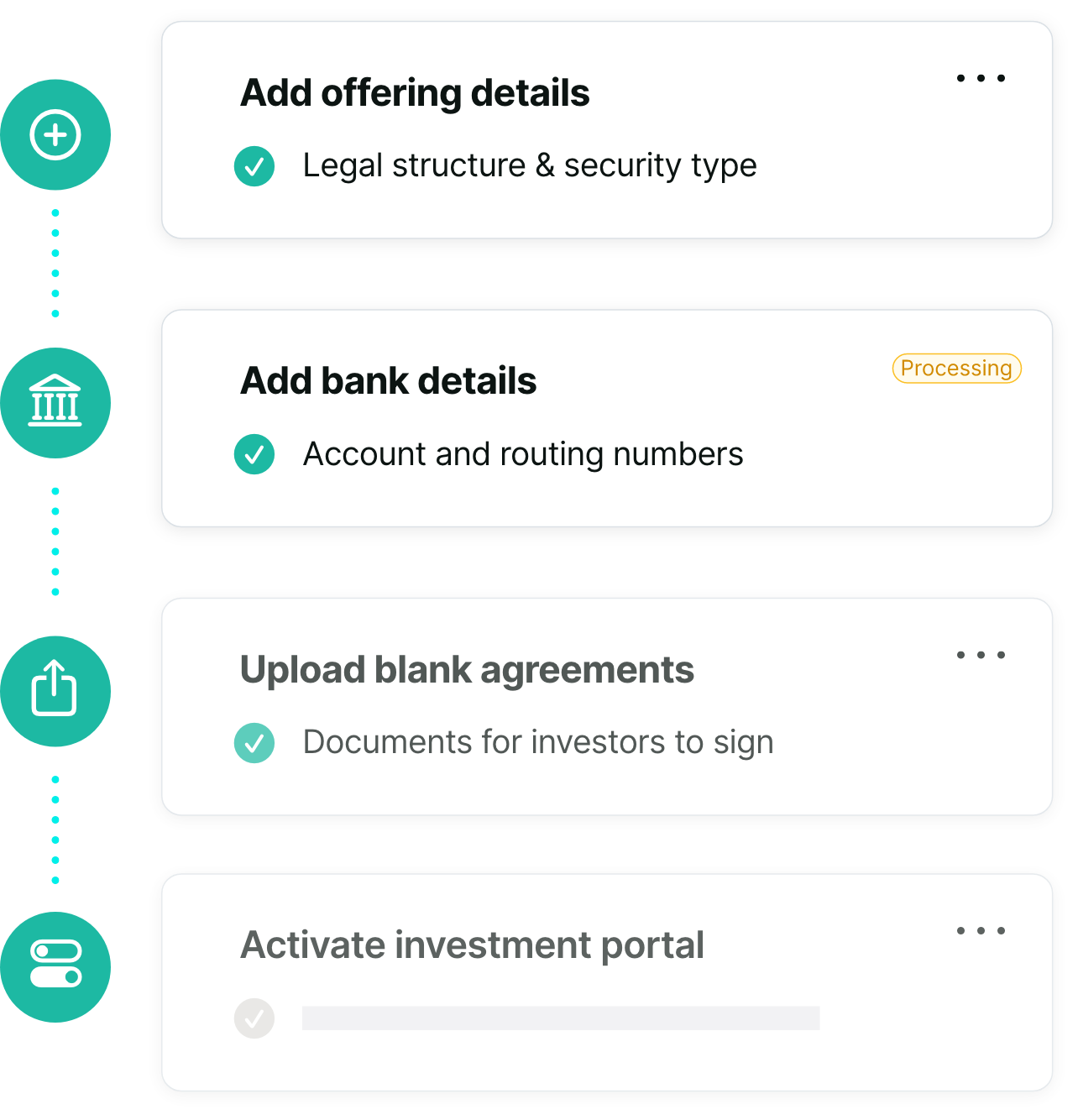

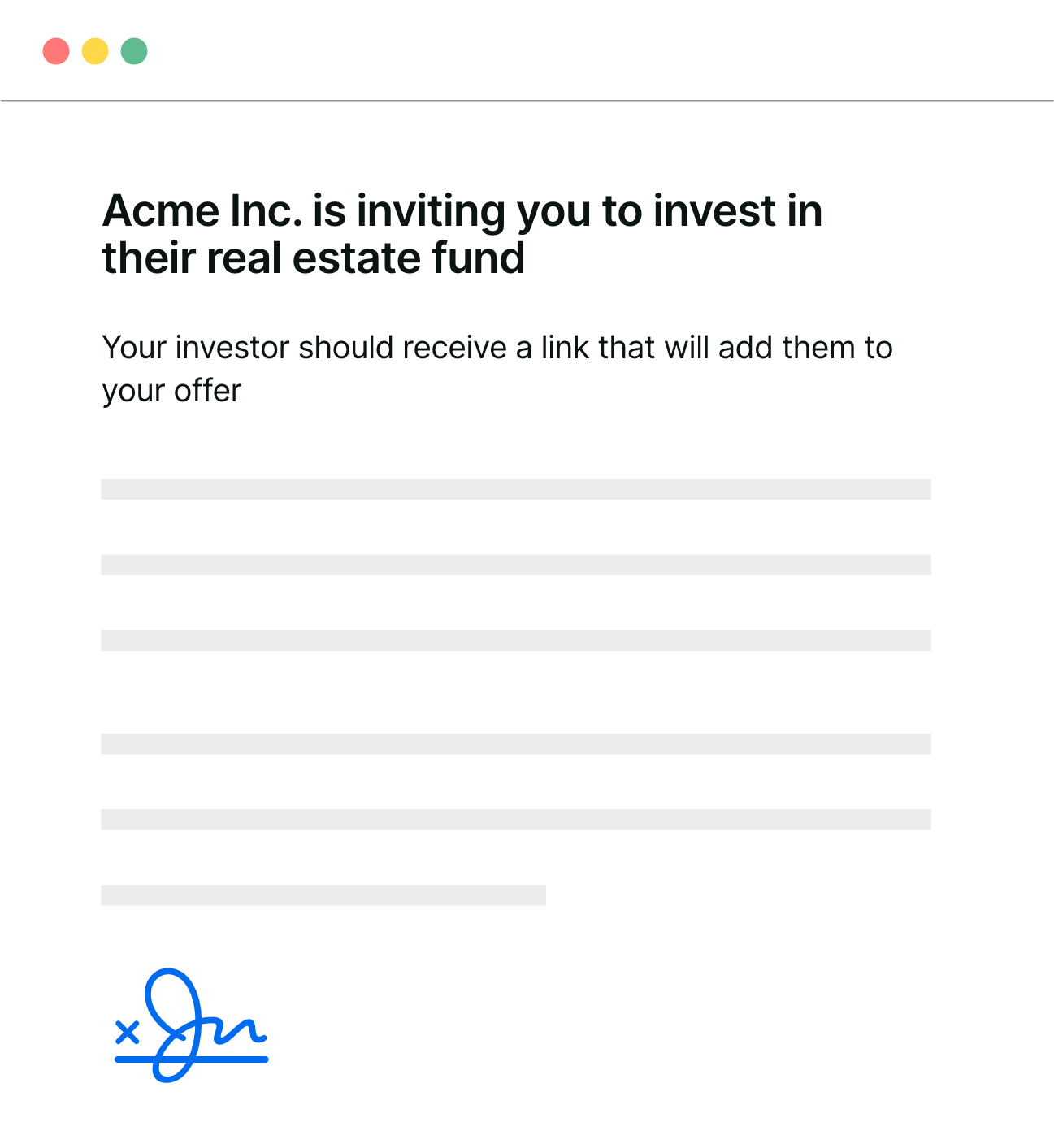

How it works

Open an account

Upload offering documents

Invite investors

TECH-FORWARD

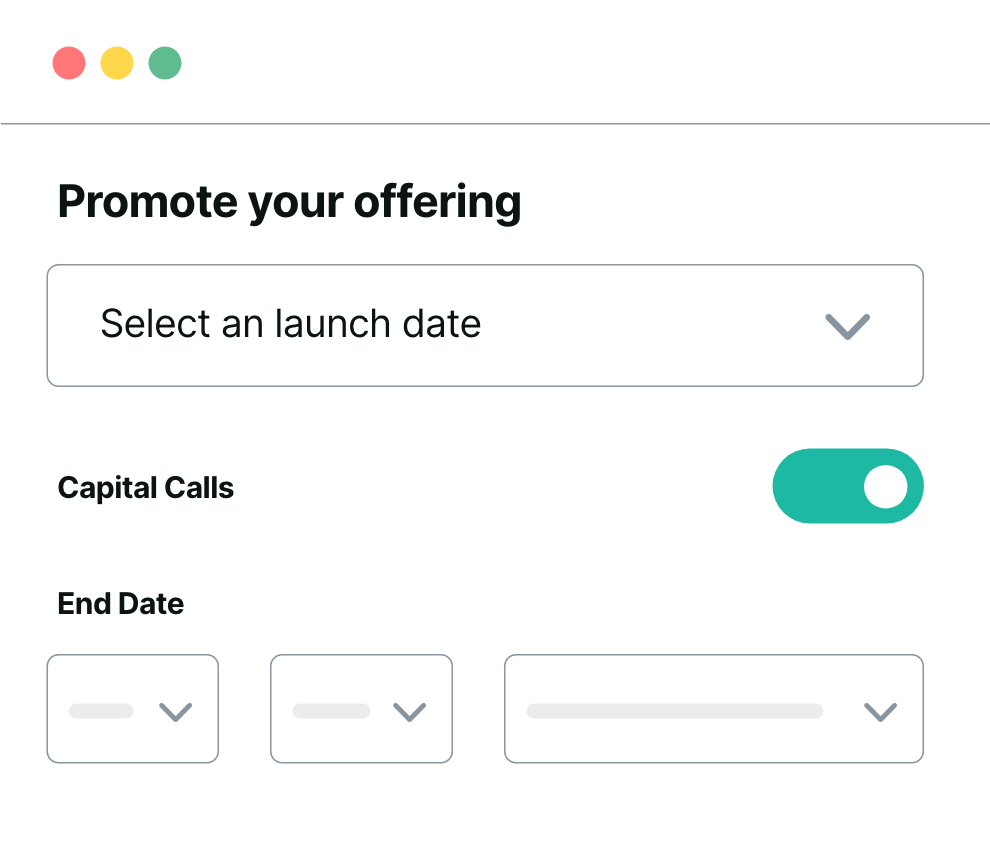

Accepting IRA capital simplified

Alto replaces what was a people- and paper-intensive process with an end-to-end solution that takes just minutes to complete.

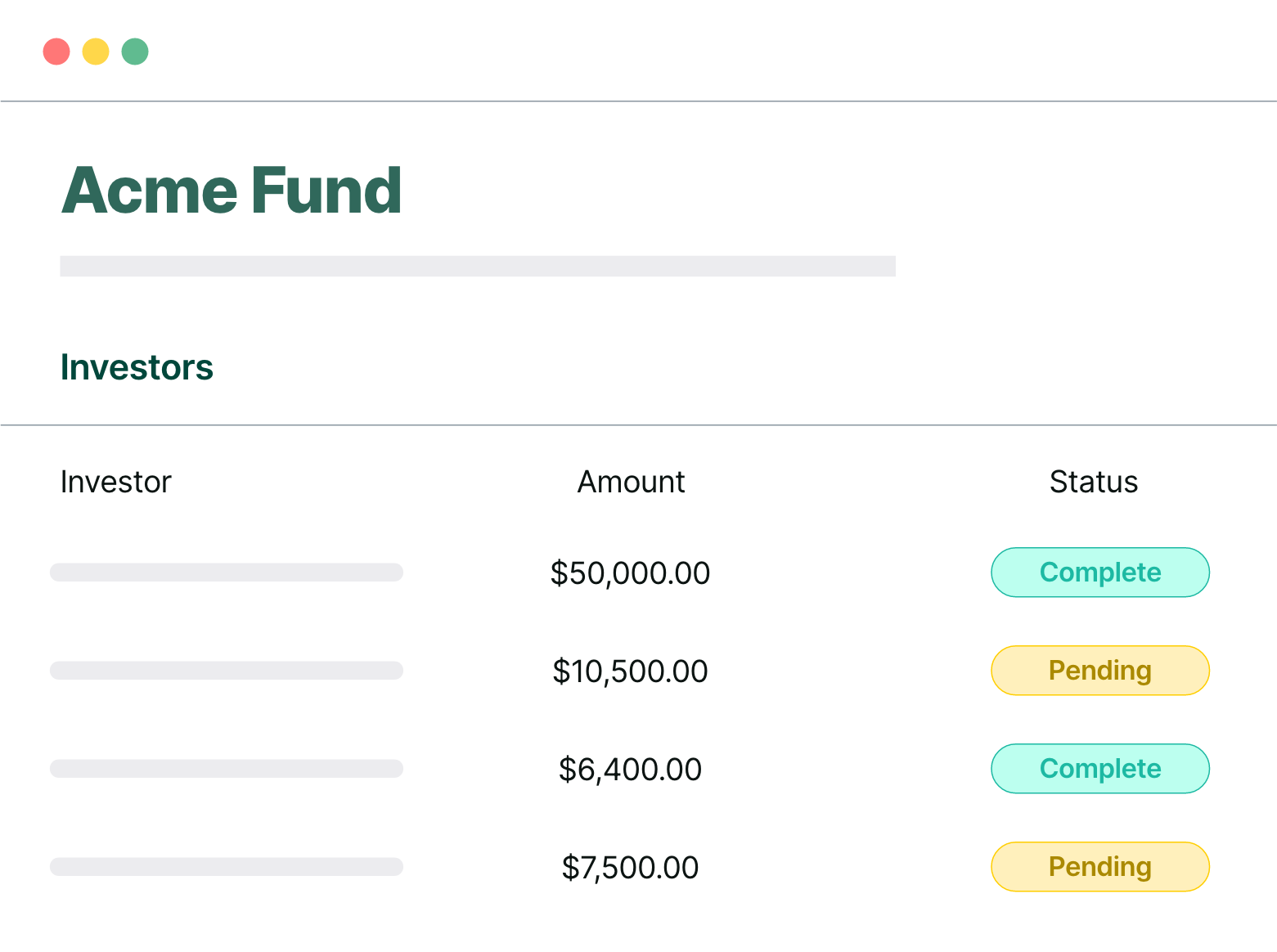

STREAMLINED EXPERIENCE

Manage your capital with ease

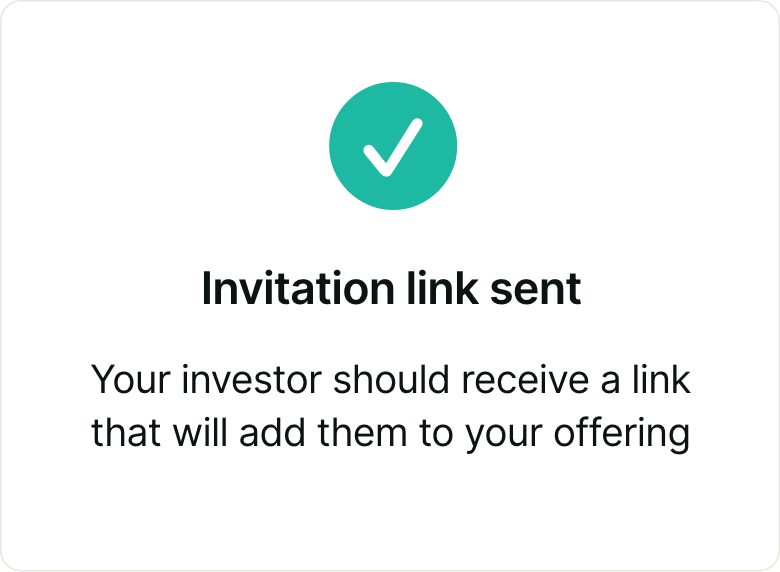

- Invite investors directly from the platform.

- Monitor investor onboarding, funding, and investing status through your dashboard.

- Send distributions by ACH, wire, or mail.

FRICTIONLESS

Easy for you, easy for your investors

Strengthen your relationship with your investors by providing them a frictionless way to invest—with no hidden fees.

Recognized in top financial publications

According to research by Alto, millennials hope to retire at 59, though they're not sure how.

Alto recognized among 11 tech startups labeled "the new generation of wealth-tech."

The Alto IRA named to Real Simple's 2022 Smart Money Awards list for best nontraditional retirement plan.

Got questions?

Well, we've got

answers.

Alto is a self-directed IRA custodian that enables individuals to invest in alternative assets through a variety of partnerships and Alto’s capital raise platform, which allows issuers to bring individual offerings to the table.

By accepting IRA capital, you’re allowing your investors to tap into what could be their largest source of investable assets: their retirement funds. That means potentially closing your raise sooner. And by leveraging IRA capital, your investors are able to take advantage of the tax advantages afforded to traditional, Roth, and SEP IRA accounts. The type of deal and amount of investors that may access an offering is decided upon by the issuing company.

There’s no cost to raising private capital using Alto. We don’t charge a placement fee, and we don’t take a cut of your raise, so you get every IRA dollar you accept.

Not at all! For too long, investing in alternative assets using a self-directed IRA has been an expensive and laborious process. That goes against everything we stand for. At Alto, we’re on a mission to make alternatives accessible for all, and that starts with pricing that is fair. It’s also why we offer two pricing plans.

Individuals looking to invest in deals they source or that issuers invite them to through their Alto IRA will need to choose our Pro plan, which carries a low account fee of $25/month (or $250/year). Additionally, they’ll pay a $75 investment fee on every private investment they make. And that’s it!

Alto supports non-accredited investors as well as accredited investors. Anyone can create an Alto IRA account, though some offerings are open only to accredited investors. This determination is entirely up to the company issuing the offering.

The number of investors allowed to participate in an offering is dependent on the rules and regulations of the Securities Act of 1933. For example, offerings under Rule 506(b) of Regulation D can have an unlimited number of accredited investors, and up to 35 non-accredited purchases.

You’ll likely find that most questions you have are answered on our Issuer Support page; however, if you have a question we didn’t answer, you can contact us here.

“Alto helped us explore IRA capital, raising more than a half million dollars in the process.”

Elle Williams

Director of Business Development, Vint

Trusted by investors and issuers nationwide

You focus on your business. We’ll handle the rest.

*Alto does not represent, warrant, or otherwise guarantee the success of an offering on its platform. Issuers are solely responsible for engaging investors and raising capital for offerings uploaded to the Alto platform. Alto will not recommend or otherwise market an offering to its clients.