VENTURE CAPITAL: AN OVERVIEW

An introduction to venture capital investing with Alto

December 15, 2023

Venture capital is often associated with innovation and headlines covering market-making companies.

It’s an intriguing asset class to many — yet institutional constraints have limited access to a relatively small pool of investors.

We believe venture capital’s reputation for inaccessibility is quickly becoming outdated.

As an alternative asset, venture capital is an increasingly interesting option to diversify individual portfolios, while potentially reducing risk and offering private market growth potential. Venture capital has garnered impressive results, even since the market turbulence of 2021, while $240 billion was invested in the sector in 2022 alone. Now, individual investors can tap into the market too while strategically investing for retirement.

Below, we explore some key considerations if you’re curious about investing in venture capital with funds from your tax-advantaged IRA.

In this overview, Alto covers:

1. Why alternative assets can be beneficial

2. 3 potential benefits of venture investing

3. What we think the future may hold for venture capital

4. How to start investing in venture capital today

First things first: what are alternative assets?

Alternative assets are financial assets that do not fit into conventional stock, bond, equity, income, or cash investment categories. For instance, individuals saving for retirement can invest in real estate, private equity, startups and venture capital, securitized collectibles, and farmland through their Alto IRAs.

Investing in alternative assets can offer portfolio diversification

While more than half of investors actively invest in traditional public market investments — like stocks, bonds, mutual funds, and ETFs — high-net-worth individuals and institutional investors tend to allocate at least 10% of their portfolios to alternative assets.

This strategy is rooted in the fact that alternatives can contribute greatly to portfolio diversification.

Portfolio diversification can reduce your chances of large losses by spreading investments across different asset classes, which are ideally non-correlated to one another. Even if an event negatively impacts one holding, diversification helps ensure it won’t hit all of your investments.

Why is that?

Alternatives are largely non-correlated to the public markets

Over 60% of Americans report investing in public markets, yet these spaces are largely correlated.

Meanwhile, high-net-worth individuals (such as Bill Gates, Ted Turner, and Jeff Bezos) and institutional investors tend to allocate funds outside of traditional stocks and bonds.

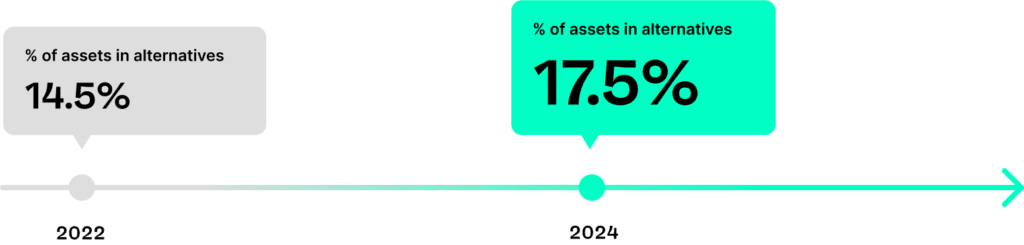

It’s not just the ultra-wealthy allocating to alternatives. Professional investors like registered investment advisors utilize these less traditional assets as well. According to a 2022 survey by Cerulli Associates, advisors allocated an average of 14.5% of assets to alternatives and seek to increase this to 17.5% by 2024. Why?

The stock market is typically dependent on interest rates, the bond market, and the economy, while a notable amount of inflow goes directly to index funds. In fact, as of 2021, roughly $11 trillion was invested in index funds.

As for the bond market, CNBC reports that if the yield on ten-year bonds reaches 4.22%, more money goes into the stock market. Conversely, if yields reach 4.35%, more money goes into bonds. This means investors are faced with a tight range of bond volatility tied to interest rates.

Sixty-nine percent aimed to reduce exposure to public markets, while 66% aimed to dampen volatility and protect from downside risk. More than half (52%) also cited general portfolio diversification as a motivation for alternative investing.

As affluent investors increasingly turn to alternative strategies and alternative asset classes are projected to double in size, one asset class stands out for its resilience amid market turbulence and investment in innovation.

3 reasons to consider adding venture capital to your portfolio

Venture capital is a popular option for early-stage companies to finance their initial operations before they begin earning revenue and achieving profit to self-fund growth.

Venture investing has often helped companies that have become widely considered as revolutionary, like Google, Uber, or Meta. Many such companies have changed the world, and that’s reflected in the pure size of the venture ecosystem. As mentioned, $240 billion of venture capital was invested in the United States in 2022 alone.

There are many reasons to consider venture capital. Here are a few of the attributes that have attracted investors to this asset class.

Venture capital has shown resilience to recent headwinds

When you invest in VC, you invest in an asset class that demonstrates persistence in turbulent markets. For instance, even as volatile market conditions took hold in 2021, venture capital raised, deal activity, and exit values in the U.S. all continued to rise.

Investment analysts attribute this consistency to the “VC flywheel,” wherein a strong exit market and higher returns lead to increased investor liquidity and interest in the landscape. That momentum then translates to an enhanced fundraising ecosystem.

Another factor at play is the persistence of manager performance. Researchers have found top-quartile VC managers often repeat impressive performance: Since 2000, over 70% of all top-quartile funds delivered above-median returns in their subsequent funds.

Fortunately, individual accredited investors have new ways to participate in this asset class — including the Alto partnerships we’ll outline below.

Value shifting from public to private markets

Over the past two decades, we’ve seen public markets shrink and private markets accrue more value. On a macro scale, there are half as many public equities as there were 20 years ago, while cash and growth opportunities shift to the private side.

Many of the largest endowments and institutions have already increased their allocations to private funds respectively. However, if your portfolio is focused on public equities — like many individual investors’ — you may not stand to profit from that macro capital reallocation.

Portfolio diversification & risk mitigation

Venture capital is largely uncorrelated to the public markets, offering diversification that can help investors mitigate risk and potential losses.

VC investments also mature on a longer time horizon, as startups require time to grow and scale. This makes them an exceptional way to variate retirement portfolios — and a prime complement to stocks, bonds, and real estate in a responsibly diversified IRA.

Why venture capital has historically been inaccessible

Venture capitalists typically have years of firsthand experience in the market segments they invest in. Beyond their active investment strategies, they work to create ROI within their portfolio companies by sitting on boards, consulting on operations, and making warm introductions through their networks. That knowledge and experience is how VCs recognize and enable potential growth and returns.

Historically, that level of requisite industry exposure is what made the asset class difficult to access for everyday individual investors saving for retirement. For instance, VC investing was mainly practiced by institutions, endowments, or pension funds.

Alto partners with venture capital firms to offer individual accredited investors access

Many investors have known venture capital as an alluring asset class — it just hasn’t been easy to participate. That’s changing as innovative new firms make the exciting world of venture capital more accessible.

Alto looks to drive the trend forward through partnerships with two venture capital firms: Alumni Ventures and Kearny Jackson.

Alumni Ventures provides nearly 10,000 individual investors access to venture capital portfolios

Alumni Ventures helps accredited investors access high-quality venture capital deals — with investment minimums starting as low as $10,000. To date, nearly 10,000 individuals have invested in Alumni Ventures’ various portfolios.

For every portfolio company, Alumni Ventures leverages its network of 650,000+ members, organized through alumni associations at top schools like Harvard and Dartmouth. The firm leans on this community to:

- Source top-of-funnel deal flow, including 50–75 quarterly investments

- Co-invest with other firms like General Catalyst and Greylock Partners

- Introduce leaders at portfolio companies to capital, connections, and customers

This strategy has paid off for Alumni Ventures, its portfolio companies, and its participating investors. In 2022, Pitchbook ranked Alumni Ventures the most active venture firm in the US.

Interested accredited investors can explore Alto’s partnership with Alumni Ventures through the Alto Standard IRA.

Kearny Jackson brings a track record of spotting top

founders first

Kearny Jackson aims to spot promising founders before some of the biggest names in venture capital.

Sriram Krishnan and Sunil Chhaya, Co-Founders of Kearny Jackson, anticipate SaaS, infrastructure, and fintech being reliable investment sectors thanks to global digital transformation, and their investment strategy matches the assessment. Plus, as software and VC veterans, they have the expertise and connections to support up-and-comers in the space.

Notably, Kearny Jackson was one of the first investors in pre-seed and seed rounds for:

$82M

raised from Accomplice, Bain Capital, and ICONIQ

$88M

raised from a16z, Accel, and First Round Capital

$57.5M

raised from Sequoia Capital, Tiger Global, and IVP

Their track record of early stage investments like these has garnered interest from high-profile investors like Sequoia Capital, Kleiner Perkins, Marc Andreessen, and Reddit co-founder Alexis Ohanian.

Now, through Kearny Jackson’s partnership with Alto, individual investors can participate, too.

What’s on the horizon for venture capital?

Venture capital is an exciting asset class that’s already moving markets — and helping businesses shape the world we live in. Many tech heavyweights, including FAANG companies, got their start thanks to critical support from venture capital funds.

The last three years alone have been both exciting and tumultuous for venture capital:

- After COVID-19 impacted nearly every industry in 2020, VCs experienced an unprecedented explosion in 2021.

- While 2022 saw a sharp dip in the sector, it’s returned to a baseline that’s still $100 billion greater than 2020.

While there’s no way to predict how any startup or market will perform, venture capital remains a seemingly attractive way to diversify a retirement portfolio.

Venture capital can anchor a portfolio for long-term return potential

Alternative assets like venture have long been accessible to high-net-worth individuals and institutional investors. Now, the means exist for nearly any accredited investor to participate in venture capital and diversify their retirement portfolio.

There are many compelling reasons to consider an investment in alternatives like venture, including:

1.

Resilient performance during turbulent markets

2.

Accessing capital potential that’s shifted into private markets

3.

Diversification and risk mitigation, thanks to low correlation with public markets

Take control of your portfolio and your future

Trusted by over 25,000 investors**

*Investors include active customers with an Alto IRA or CryptoIRA account as of 10/2/23.

**Trust Pilot reviews may not reflect the typical experience of all clients.