You’ve got alternatives.

Invest in them with an Alto IRA.

For the trajectory to change, the approach must change. Invest in alternatives and get the benefits of a diversified portfolio with your Alto self-directed IRA.

As seen in

- Portfolio Diversification

- Benchmarked Returns

- Direct Ownership

get started

Ready to get started? Open an IRA today.

Alto IRA

Tax-advantaged investing in private equity, venture capital, real estate, art and other real assets with the potential for outsized returns.

Alto CryptoIRA®

Streamlined Transactions

Alto provides a paperless experience that streamlines the private investment process.

More Optionality

No preset menu of investments.

Control your investments

Pick from a curated marketplace of offerings with potential for outsized returns.

Tax Advantages

Enjoy deferred taxes, or no taxes, on all gains inside your Alto IRA or Alto CryptoIRA2.

1) Quantity and selection of tokens/coins available from CryptoIRA exchange partners may vary from state to state.

2) Traditional IRAs and SEP IRAs generally are tax-deferred; Roth IRAs generally can be tax-free. Tax-free treatment subject to Roth IRA holding period and other restrictions.

Tax treatment of contributions and distributions subject to applicable regulations. Consult your tax advisor before investing.

a timeless wealth strategy

Why You Should Invest in Alternative Assets

Everyone’s financial situation and goals are different, but generally, assets that may not be as attractive in the short-term can become more desirable over a longer period of time.

Assets with low liquidity or limited exit opportunities such as artwork, fine wine, real estate, venture capital and private equity can be suited for long-term investing, which can be a great use of dollars earmarked for retirement.

why alto

A better way to invest

An IRA is a powerful way to reduce your tax burden as you prepare for retirement. Now imagine having instant access to offerings that could help you build wealth in that IRA.

tax advantages

More Opportunities. Fewer Taxes.

- Contribute to a traditional IRA which may lower the amount of taxes you pay now so you can invest pre-tax money for later.

- Contribute after-tax funds to a Roth IRA and never pay taxes on qualified distributions or gains.

- Defer taxes until retirement with a traditional or SEP IRA.

Offerings may be accessed through the Alto Marketplace and are available only to accredited investors. Offerings displayed are representative of the types of deals accessible on the Alto Marketplace but may not reflect active offerings. All securities involve risk and may result in significant losses.

the next big thing

Invest in What You Know and Love.

With your Alto IRA, you can invest in alternative assets that you’re passionate about, and reap potential returns with reduced exposure to market volatility.

- Real Estate

- Crypto

- Venture Capital

- Private Credit

- Fine Art

- Private Equity

Real Estate

For those intrigued by how the world is built

Real Estate

Real Estate

For those intrigued by how the world is built

Self-Directed ira

Take Control of Your Financial Future.

With a self-directed Alto IRA or CryptoIRA, whether on your own or with an advisor, you get to choose the investments best-suited to your long-term goals.

security

We Invest in Security So You Can Invest with Confidence.

Investing for retirement is serious business, and Alto takes the trust that our investors put in us seriously. Our systems employ best in class protections for security of your assets, cash, and personal data.

Cash funded IRAs are maintained in FDIC-insured accounts with our banking partners

Crypto held by Coinbase is kept 1:1 in institutional-grade hot and cold storage

Alto enables and encourages two-factor authentication (2FA)

Our Investment plans

FLEXIBLE

Min Deposit: $100

Max Deposit: $4999

ROI: 10%

Duration: After 24hours

Financial planning session

24/7 live Support

Referral Bonus: 10%

MARGINAL

Min Deposit: $5000

Max Deposit: $9999

ROI: 11%

Duration: Daily for 7days

Financial planning session

24/7 live Support

Referral Bonus: 10%

EQUITY

Min Deposit: $10000

Max Deposit: $49999

ROI: 15%

Duration: Daily for 14days

Financial planning session

24/7 live Support

Referral Bonus: 10%

ASSOCIATE

Min Deposit: $50000

Max Deposit: $99999

ROI: 30%

Duration: Daily for 30days

Financial planning session

24/7 live Support

Referral Bonus: 10%

VIP

Min Deposit: $100000

Max Deposit: $unlimited

ROI: 50%

Duration: Daily for 6months

Financial planning session

24/7 live Support

Referral Bonus: 10%

open your account

Getting Started with Alto Is Easy.

Sign up

Sign up to create your Alto IRA or CryptoIRA.

Pick account type

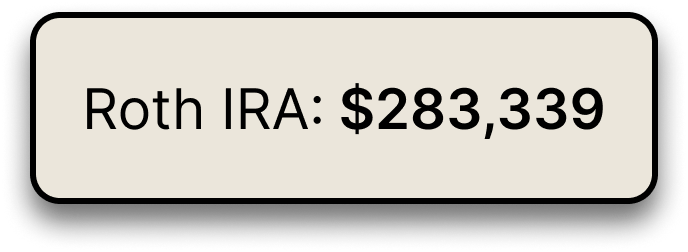

Select a traditional, Roth, or SEP IRA to invest with.

Fund your account

Contribute cash or roll over funds from a retirement account.

Start investing

Explore the options to invest in your future.

Got questions?

Well, we've got

answers.

Self-directed IRAs offer the same tax advantages as conventional IRAs. The difference is self-directed IRAs let you invest in a variety of alternative assets historically off-limits for everyday investors—including art, crypto, farmland, startups, and real estate.

Opening an account with Alto is easy. You simply click Get Started at the top of the page, complete the legally required Know Your Customer (KYC) process, select either an Alto IRA or CryptoIRA, and choose the type of IRA you want to invest with.

You can open a traditional, SEP, or Roth Alto IRA or CryptoIRA.